Finance

![]()

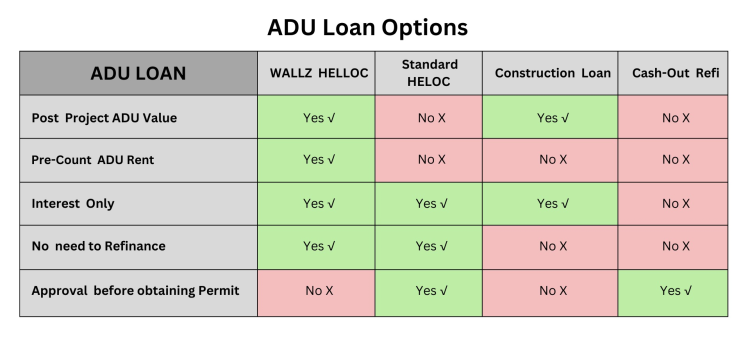

Constructing an ADU requires the right financing. We’ve partnered with national lenders and local credit unions to provide competitive rates and flexible terms, all without the need for refinancing. Recognizing that traditional financing may not suit newer homeowners or those with significant home equity but limited cash, we offer a specialized loan designed specifically for ADU construction.

WALLZ HELOC

Wallz Home Equity Line of Credit (HELOC) for ADUs considers expected rental income. Lenders factor in projected income to determine eligibility, potentially improving terms. This financing aligns with the income-generating potential of the ADU.

Standard HELOC

A revolving credit line, secured by home equity, enabling borrowers to access funds as needed with variable interest rates during the draw period.

Construction Loan

A short-term financing option for building projects, providing funds in stages based on construction milestones, with a focus on property development.

Cash-out Refinance

Replacing an existing mortgage with a larger one, allowing borrowers to receive the difference in cash while refinancing their home.

We’re your supportive partner throughout the journey of your ADU project. Begin the process today by arranging a complimentary consultation with a Wallz ADU expert. Together, we’ll craft a project plan, establish a budget, and devise a financing strategy tailored to your ADU. Ask us anything about your ADU financing options; we’re here to help. Additionally, we’ll introduce you to an independent mortgage broker who can guide you to the right loan product, we’ll stand by you every step of the way.